The typical four-wheelers and two-wheelers that we currently use operate on internal combustion engines (ICEs). These ICEs burn fuel and gases for power.

In contrast, Electric vehicles (EVs) run on electric motors, converting electric power into usable energy for operation. Thus, an electric vehicle could potentially replace the current-generation automobile in the near future as a means of reducing carbon dioxide emissions.

Electric vehicles are crucial to achieving net-zero emissions, as outlined in the Paris Climate Accords. The European Union is setting a high bar in adopting electric vehicles with its laws, while the rest of the world is catching up.

Around the globe, countries are promoting electric vehicles in place of internal combustion engines (ICEs). Nations can move towards net-zero emissions by reducing vehicular emissions by 2040.

In India, markets for electric vehicles were valued at USD 5 billion in 2020 and may reach USD 47 billion by 2026, growing at a CAGR of more than 44% during the projection period (2021-2026).

FAME India has brought significant momentum to India’s EV market to enhance e-mobility in response to global policy commitments and environmental challenges.

With the promotion of electric vehicles, the Centre aims to adhere to the Paris Climate Accords. Some steps taken by the government include the below.

- As of August, the Ministry of Road Transportation and Highways (MoRTH) declared that electric vehicles would not have to pay fees when acquiring or renewing their registrations.

- Additionally, the government has cut the GST component on EVs in the previous years to 5 percent.

A notable benefit that the government provides to those who purchase electric vehicles is a tax rebate.

So, what are the tax benefits of buying an electric vehicle?

In her maiden Budget 2019 address, Finance Minister Nirmala Sitharaman announced several measures aimed at increasing the country’s production and purchase of electric vehicles.

The central government has proposed a deduction of ₹ 1.5 lakhs on interest payments on personal loans taken for EV purchases under Sec 80 EEB of the Income Tax Act to make electric vehicles more affordable.

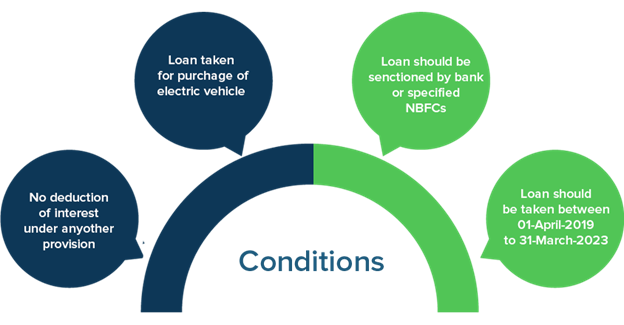

A taxpayer must meet the following conditions outlined in the figure below to qualify for tax benefits.

Source:https://tax2win.in/guide/section-80eeb-deduction-purchase-electric-vehicle

To better understand this aspect, let us use the following example:

Mr. X has applied for a personal loan on an electric car for ₹ 20,00,000. The personal loan interest rate is 10%, and he received the loan sanction on 01/04/2020. Therefore, the deduction available to Mr. X under section 80 EEB would be equal to

₹ 20,00,000*10%*12/12 = ₹ 200,000

Restricted to an amount of ₹ 150,000, being the maximum permissible limit.

Moreover, the states are implementing incentives programs and subsidies for EV purchases in addition to the benefits that FAME-II offers.

In Maharashtra, electric cars and SUVs are eligible for a capped subsidy of ₹ 2.5 lakh, while in some states in North India, grants are limited to ₹ 1.5 lakh. Meghalaya and Odisha also offer subsidy packages of ₹ 60,000 and ₹ 1 lakh, respectively.

Furthermore, Delhi, Maharashtra, Rajasthan, and the northeastern states provide subsidies ranging from ₹5,000 to ₹30,000 when purchasing electric two-wheelers.

Therefore, choosing an electric vehicle when you plan to buy a new vehicle is environmentally responsible and economically sensible.

It is advisable to compare the interest rates of different lenders when applying for a personal loan for electric vehicles. You can also calculate the EMI easily by visiting the lender’s website and accessing the personal loan EMI calculator. So, begin your journey to be an EV owner with the correct information.